Traditional banks are facing significant challenges as fintech companies disrupt their long-standing dominance in the industry. These startups, fueled by technology, are offering new and more flexible financial services, causing traditional banks to adapt or risk losing market share.

Fintech companies are reshaping the way people access financial services, creating difficulties for the traditional banking sector to keep abreast. With diminishing interest in local bank branches, customers are turning to the fresh offerings of fintech products and the incorporation of financial services into platforms by prominent tech firms.

These fresh players in the market often offer a more streamlined and user-friendly customer experience, catering to customers on their terms rather than requiring them to adhere to traditional banking norms. This simple yet powerful approach has presented a lucrative opportunity for these enterprises to attract customers away from many banks' existing customer bases.

In order to retain their customers, banks must adapt to meet their needs across various channels and locations. This entails financial institutions reimagining their fundamental purpose to prioritize customer-centricity in this new era.

Banking Industry needs a image makeover

Banks are undergoing an image makeover and prioritizing brand building efforts to attract the core banking population, which predominantly consists of the younger demographic. This generation has distinct characteristics, and with the increasing presence of fintech companies, the concept of customer service has evolved significantly.

Reevaluating the bank's brand might involve a strategic shift, such as the introduction of new services utilizing cutting-edge technology or a perceived necessity to realign corporate objectives to stay pertinent in the market.

Time for a brand update

As per Sprout Social, 64 percent of consumers express a desire to establish a connection with the brand they are contemplating purchasing from. This inclination stems from the consumers' appreciation of authenticity. They seek to trust the business they are engaging with and the products or services being offered.

If your brand hasn't undergone a refresh since jeggings were in fashion, it's high time to modernize for the new decade. Your visual identity should be contemporary and captivating, your messaging must be genuine and consistent across all platforms, and your website should be optimized to its fullest potential.

When the bank's brand feels outdated, relying on consumer sentiment alone won't keep them loyal. They'll seek out alternatives that better suit their needs. In such cases, it's crucial to consider a comprehensive brand overhaul. Perhaps your color scheme lacks vibrancy, your core values require reevaluation and refinement, or you're simply not fond of your brand font's italic version anymore. Whatever the motive, a brand refresh is essential to stay relevant and appealing to your audience.

New Brand means you have evolved

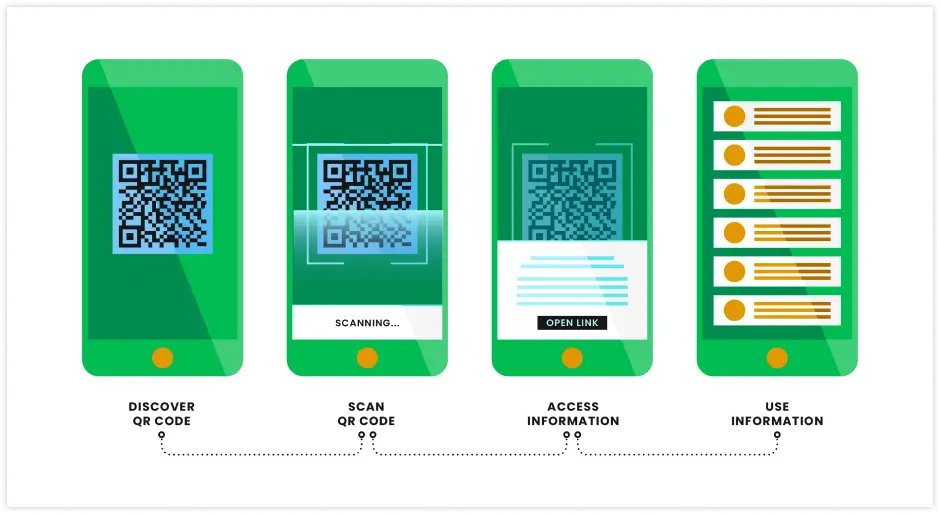

A new branding initiative for banks goes beyond superficial changes like name, logo, and colors. It signifies a transformation into a more evolved space where mobile accessibility takes precedence over traditional brick-and-mortar establishments. Banks are now focused on creating dynamic experiences and delivering products through various channels seamlessly. Furthermore, they're not just competing with other banks locally or nationally; they're also up against the latest innovations emerging from tech hubs like Silicon Valley. This shift reflects the industry's adaptation to the changing needs and preferences of modern consumers, who expect convenience, innovation, and flexibility in their banking experience.

Human interaction has become a central focus, and the rebranding efforts of banks reflect this deep-seated desire. With the digital gap exposed during the pandemic, banks are allocating significant investments to address it. The rebranding exercise serves as a declaration of the "new YOU," showcasing enhanced digital solutions designed to cater to the needs of various demographics, including small businesses, senior citizens, and the unbanked population. This renewed focus emphasizes the importance of personalized service and accessibility in a rapidly evolving digital landscape.

New brand says You are young for youth and reliable for the old and smart for the business

In today's world, people have distinct expectations regarding their interactions with banks. According to research by Adrenaline, slightly more than one-third of banks and credit unions have undergone rebranding efforts since the onset of the pandemic in 2020. These findings underscore a notable trend of brands recognizing and embracing the necessity for change to meet evolving consumer demands and preferences.

Maintaining brand strength is essential for sustained business success. The decision to undergo a rebrand doesn't always imply that the brand is outdated; rather, it can be a reflection of a robust business model. A refreshed brand signifies the infusion of new energy into the organization, akin to a 2.0 version. This renewal extends beyond technological advancements to encompass a revamped approach to customer service and overall customer experience.